In business school, you may have learned about the “blue ocean strategy,” where the goal is to be the only competitor in a thriving marketplace.

Unfortunately, in the real world, no business exists in a vacuum. Even if you created a monopoly with a new invention, copycats are sure to follow.

But just having competitors doesn’t make a product bad. By identifying your unique advantages over your competitors, you can leverage them to win loyal customers.

That’s what Porter’s Five Forces model helps you achieve.

In this article, we’ll share the benefits of working with the model, a real company example, and a 5 Forces template you can start using today.

Try Miro’s Porter’s Five Forces Template

What is Porter’s Five Forces model?

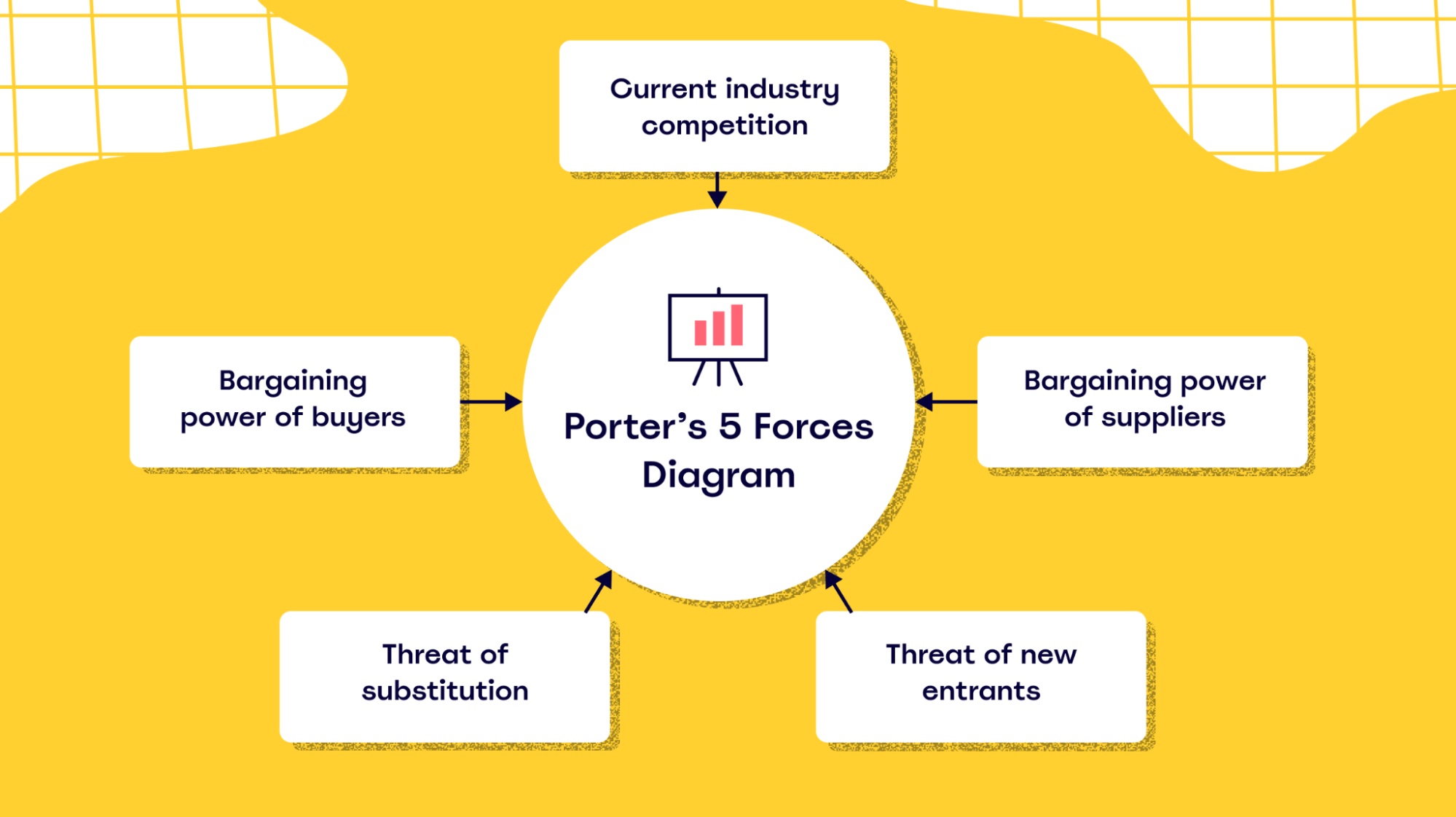

Simply put, Porter’s Five Forces is a model that lets you evaluate the competitiveness of a particular industry or marketplace. Think of it as a rudimentary business compass that helps you figure out where your product stands at any given point in time.

The framework goes beyond the relationship between you and your competitors.

It also considers your suppliers, end customers, and adjacent products that may pose a threat to your industry. It’s a complete industry analysis that focuses on the context around your product or business offering.

Harvard Business School professor Michael E. Porter first developed the tool in 1979. He designed it to help businesses analyze the competitiveness and potential of different products.

After its publication in 1979, it quickly became a highly regarded business strategy framework for evaluating competition.

What are Porter’s 5 Forces used for?

Companies use Porter’s 5 Forces to assess competitors of existing product lines, adjust their competitive strategy accordingly, explore new product ideas, and evaluate investment opportunities.

If you’re wondering why you should put so much effort into researching your competition in the first place, let’s bring you up to speed — 19% of failed startups specifically fail because they get outcompeted.

And the easiest way to let your competitors win is not knowing where you stand in an industry or marketplace. You can’t understand the long-term prospects of a product or service without knowing your current and future competition.

The Five Forces will help you identify overly competitive markets and avoid them, and find competitive advantages where possible.

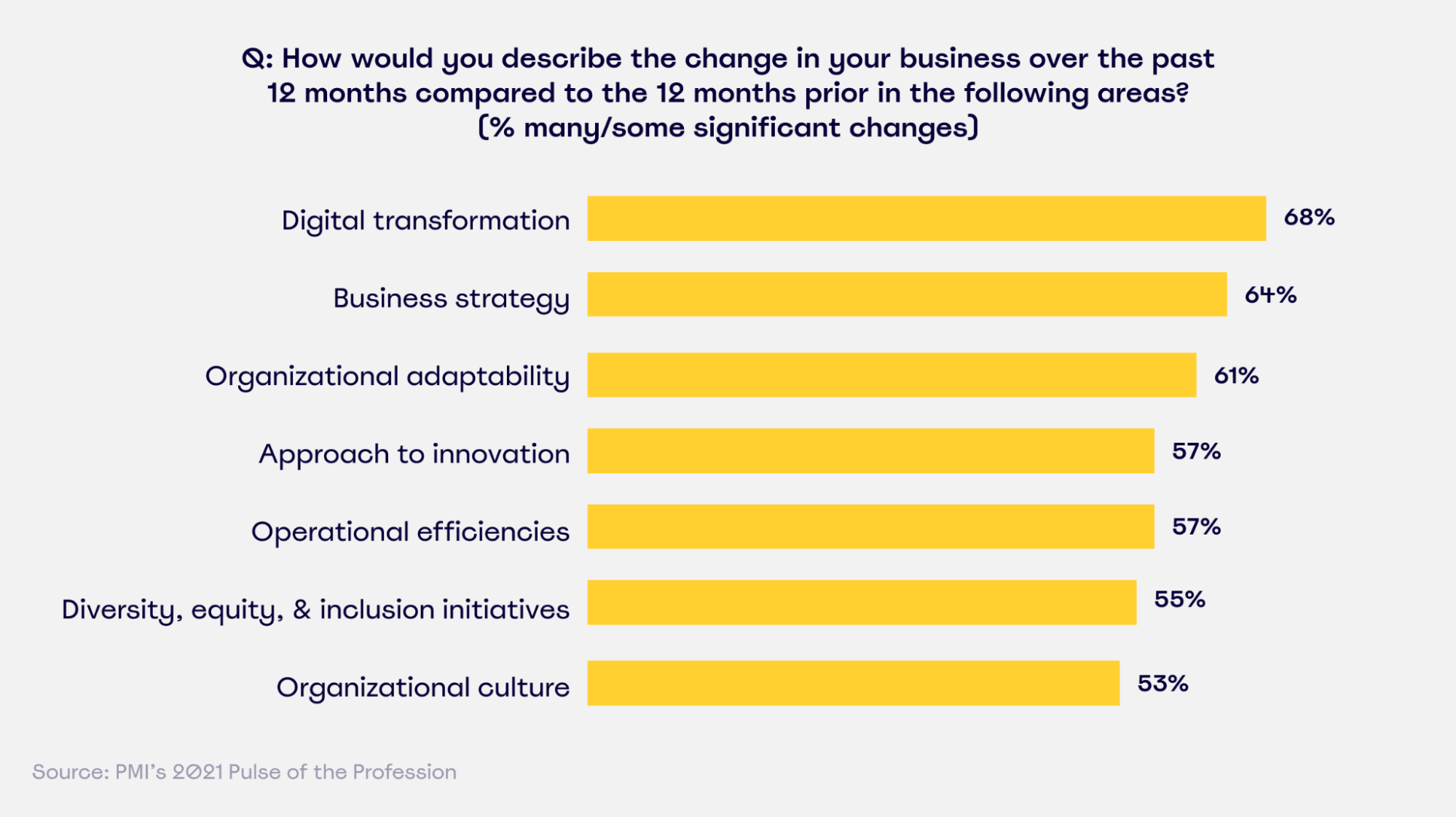

Marketplaces, businesses, and customer priorities are changing faster than ever

It’s kind of a cliché at this point, but yes, the digital revolution means that marketplaces and businesses are changing at breakneck speeds. And because of the global pandemic, even the most stubborn and old-fashioned companies can no longer resist the pressure to change.

As a result, over the past 12 months, over 53% of businesses report significant changes in areas like digital transformation, business strategy, innovation, and more.

So even if you think you know your existing competitors, don’t be so sure.

A new digital service or other innovation can quickly encroach on your business while you’re not paying attention. Just ask the Yellow Pages, the VCR player, or the road map industry.

Only by understanding the competitive forces at play can you make sound strategic decisions for the years to come.

Let’s take a closer look at the moving parts that make up the Porter model.

What are the 5 Forces in Michael Porter’s model?

Michael Porter’s 5 Forces model breaks your competitive landscape into five distinct categories, based on different stages and directions a threat to your business can come from.

Since Porter developed the model in the 70s and 80s, the main focus is on businesses that sell physical products or services, examining the relationship between suppliers, manufacturers, and final customers.

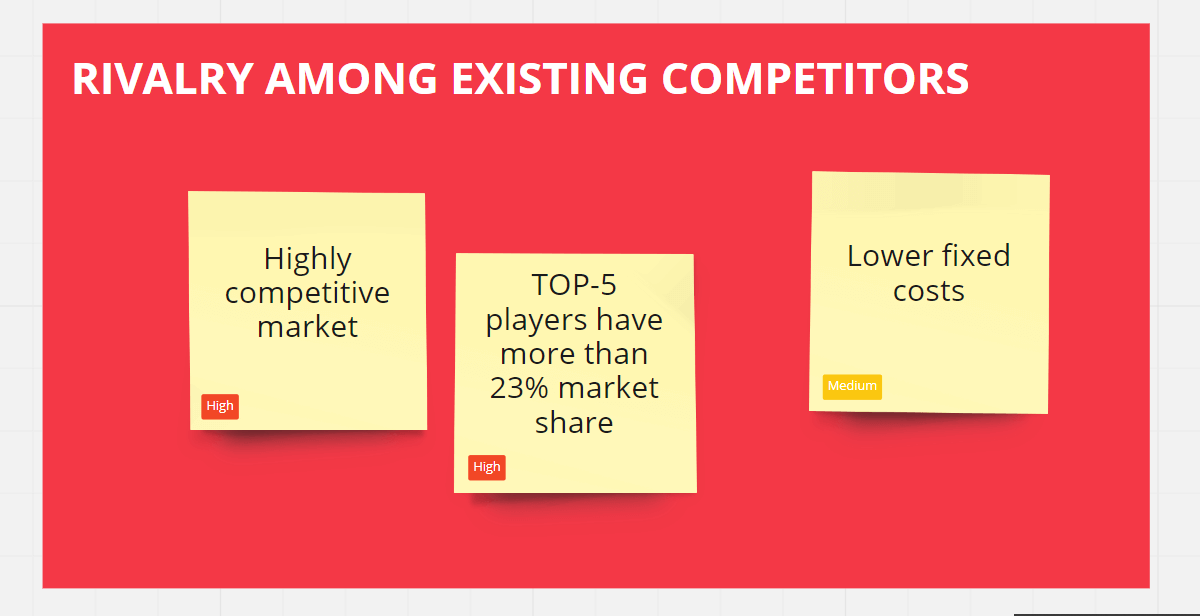

1. Competitive rivalry

The first of Porter’s Five Forces examines your competitors, how many of them there are, and their strengths and weaknesses. Are their products comparable in quality and price?

A basic industry analysis or benchmark report will include this type of information. But the Five Forces go beyond the simple existence of rivals and differing levels of market share. They also include the relationship with suppliers, buyers, and potential entrants to the market.

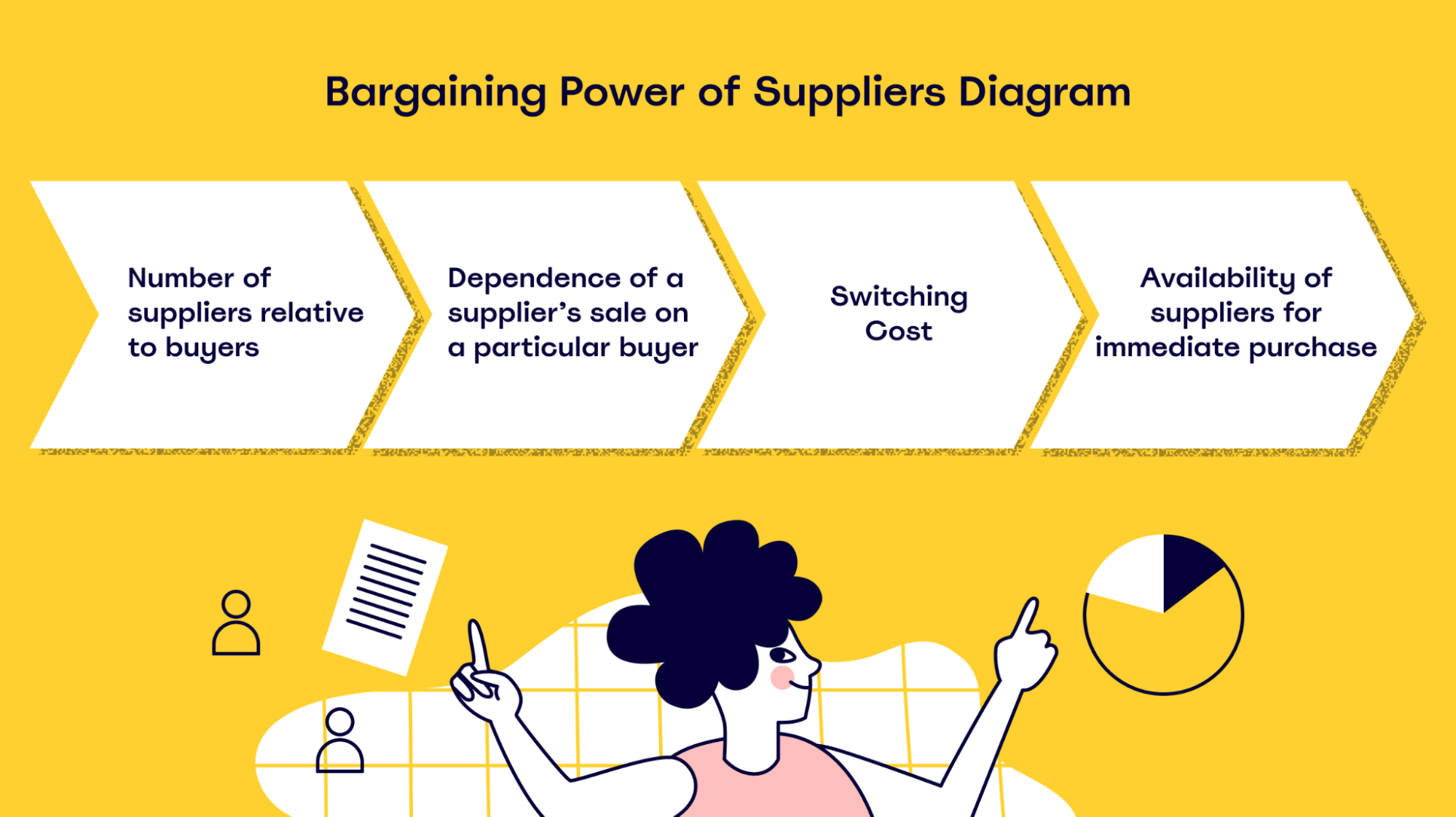

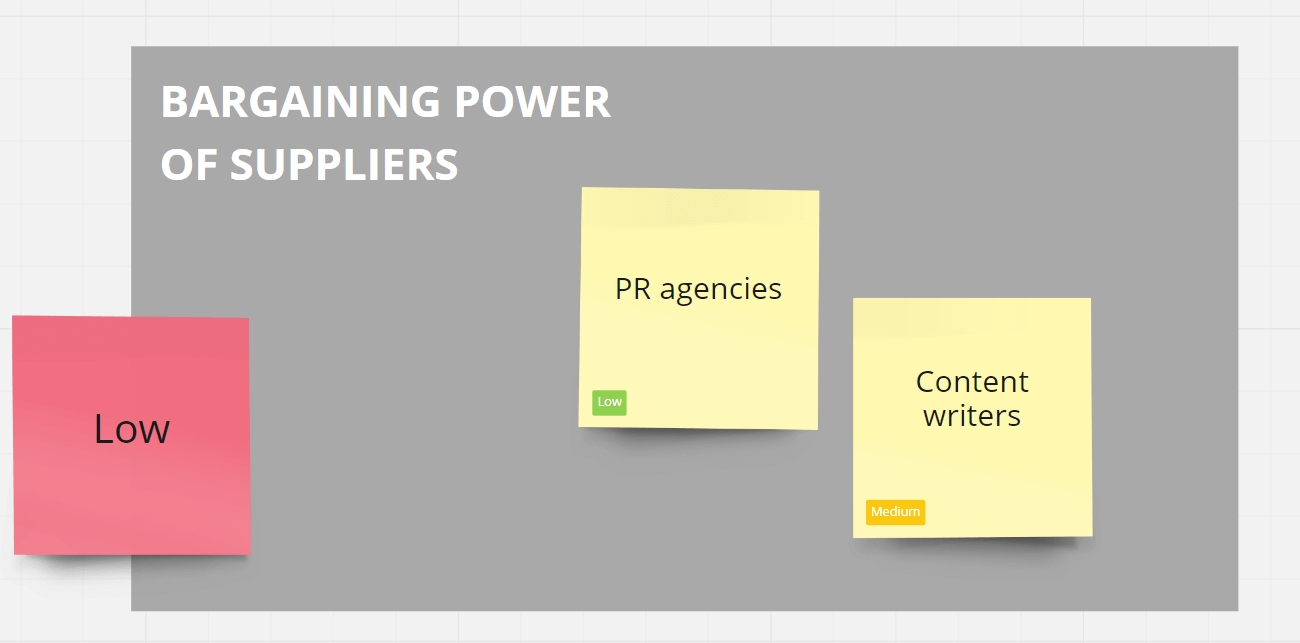

2. Supplier’s bargaining power

Next up is Supplier Power, how easy or difficult it is for the suppliers to increase their prices. The more suppliers there are, the more competition there is. In turn, that makes it easier to maintain low prices for the raw materials.

If your suppliers know you could always go somewhere else, they value your business more.

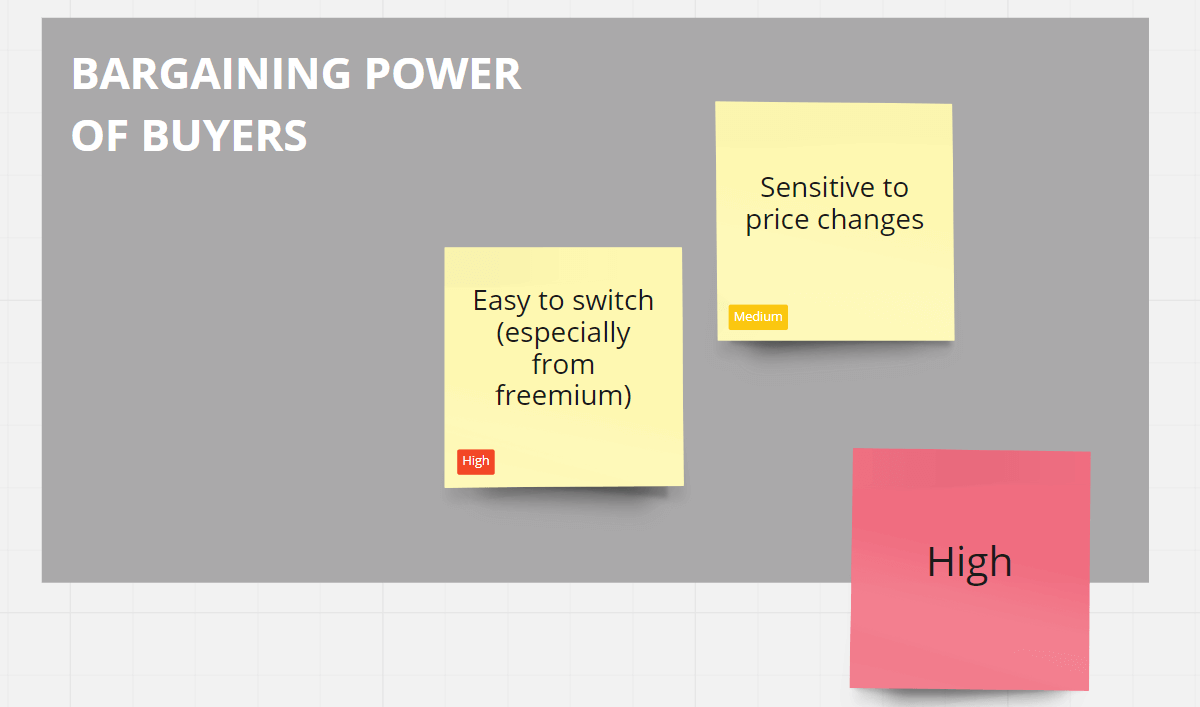

3. Buyer’s bargaining power

The lower the number of buyers and the bigger the deals, the more power they have, as a single switch to a competitor could severely impact your bottom line.

Also, the number of competitors that offer identical products here directly increases the buyer’s bargaining power. A good UX strategy can help you deliver unique value to customers that other companies can’t match — pushing the power balance in your favor.

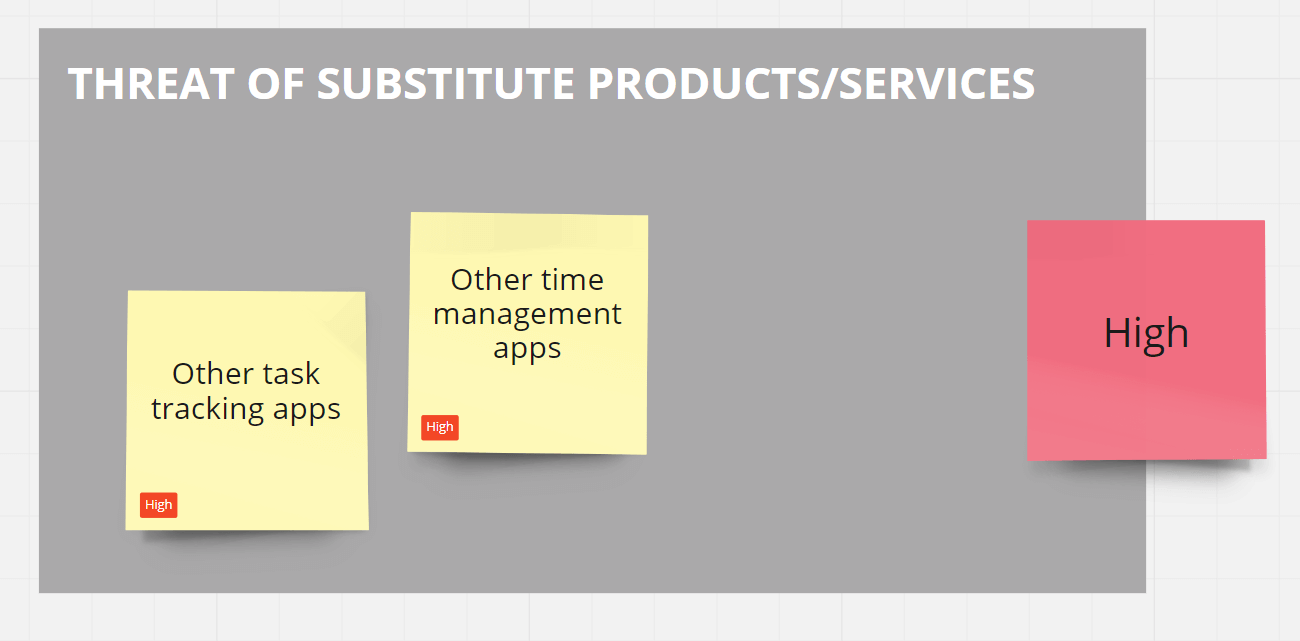

4. Threat of substitution

The threat of substitute products is the likelihood that customers will switch away from your product. Most companies only look at directly competing products, but that’s not enough.

Adjacent technology can also swoop in and disrupt your entire industry. For example, the smartphone has mostly replaced the personal digital camera. Are there developments in adjacent markets or technologies that could impact your product sales?

It’s not easy to evaluate the threat levels of total disruption.

Few taxi companies realized the threat that smartphone development would soon pose to their businesses. Instead of other taxi companies, substitute products like Uber and Lyft became their biggest competitors within a few years.

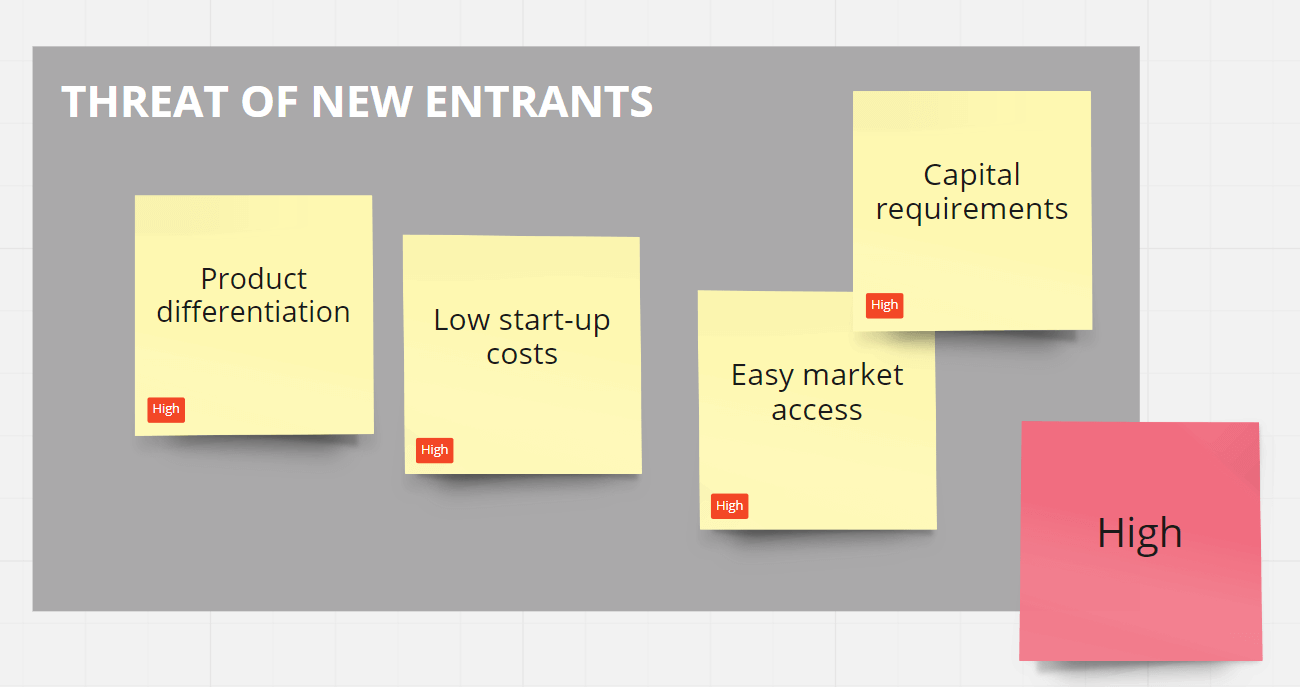

5. Threat of new entry

A new entrant is a company that starts producing a directly competing product for the first time. The threat of new entry evaluates how likely it is that a new company will enter the market.

If it requires a lot of research and unique know-how to produce your product, the threat is low. If you’re making something simple like garlic chili oil, the risk is high.

When planning a marketing strategy, you must understand the up-and-coming brands in your marketplace. You don’t want to lose market share because of a new upstart. Don’t dismiss, but look beyond the well-established existing firms in your industry.

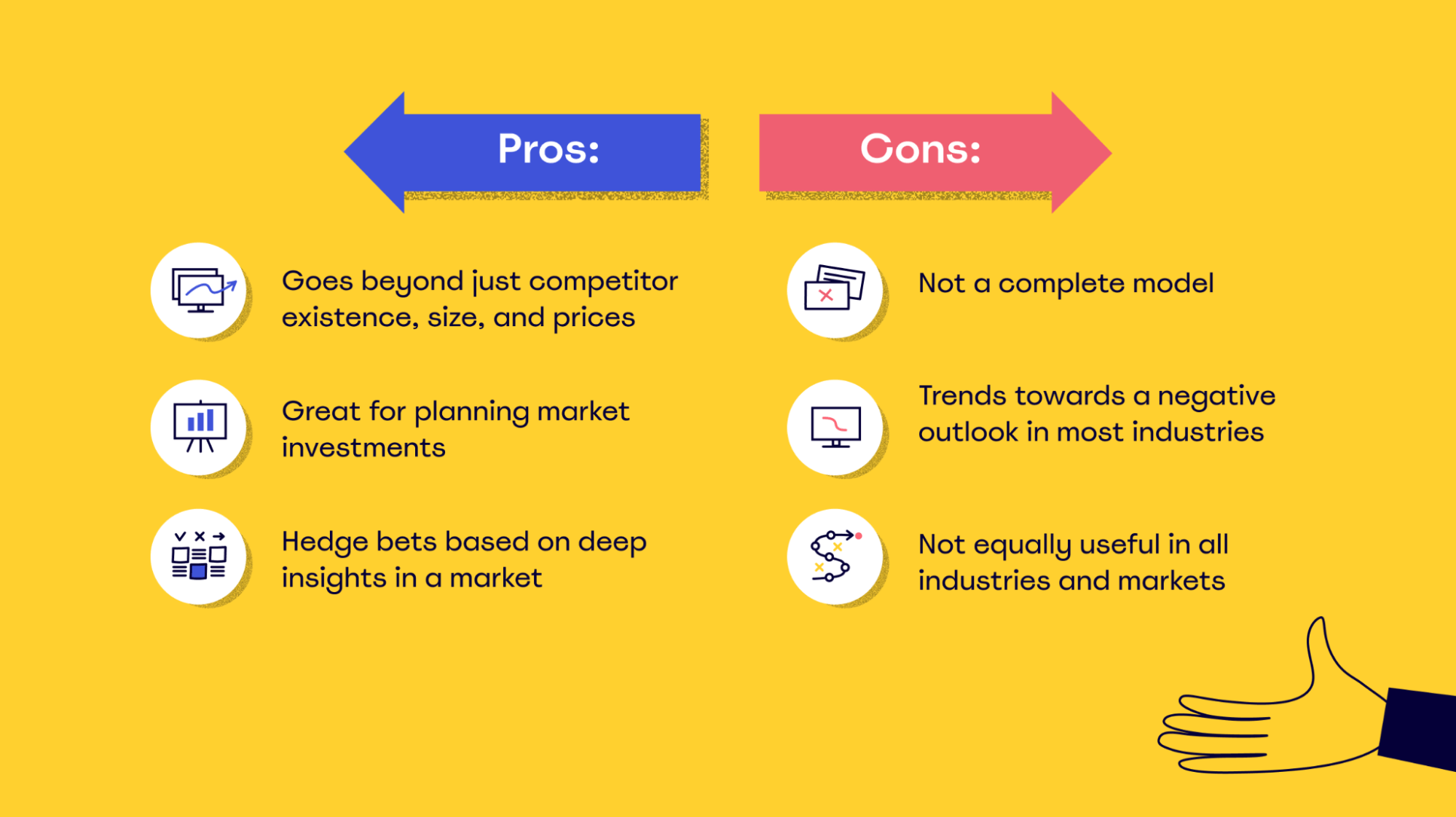

Pros and cons of Porter’s Five Forces model

Now that you understand the basics of the model and how vital competitive forces are for long-term planning, let’s explore the pros and cons of specifically using this framework for competitive analysis today.

Many things have changed since its heyday in the 80s and 90s, but have those changes rendered it obsolete as a tool for analyzing industries? Or, like the mullet, is it just as relevant today as it has ever been?

Pros

Let’s start with the good news first — the positive sides of the framework.

Goes beyond basic competitive analysis

Porter’s model goes beyond the scope of a basic competitive analysis that you might already hire a research firm to do for you.

By expanding the equation to include dynamics between suppliers, customers, and manufacturers, as well as the risk of disruption, it offers a more nuanced outlook on your future prospects.

Good for planning market investments

While it’s not a perfect tool, it’s more than good enough for planning small investments and R&D budgets.

Do you have the manufacturing capacity to produce products in an adjacent industry? Run a Porter’s Five Forces analysis first to see if it’s a viable option for your business.

You can hedge bets based on deep insights into a market

By understanding potential long-term movements inside a marketplace, you can hedge your bets against disruption or future competition.

And this doesn’t always mean you have to focus on creating a new product. Sometimes, it means moving away from reliance on a single distribution channel.

For example, if your entire business strategy revolves around selling products on the Amazon marketplace, you might think your sales will grow alongside the platform. But Amazon has a track record of releasing carbon-copy items at lower prices through its AmazonBasics line of products.

If you understand this unique new entrant threat, you can invest profits into social media marketing and selling directly to consumers to hedge your bets from the get-go.

Cons

Unfortunately, no model or framework is perfect, and Porter’s is no exception.

Little focus on stakeholder relationships past government regulations

While the Porter model includes barriers to entry — like regulating bodies — and suppliers and customers to the equation, it doesn’t include enough focus on stakeholders.

For example, working with business partners and resellers in a certain region can represent a competitive advantage that’s hard to quantify within the model.

It’s not a perfect tool for analyzing where any product line lies in the marketplace.

Viable markets may seem undesirable

Because no marketplace is without existing or future competitors, it can be easy to come away with overly pessimistic conclusions.

If you paint with a broad stroke, it can be easy to overlook your unique competitive advantages and how to differentiate yourself from your competitors.

Not equally useful in all industries

For example, fast-moving digital markets that don’t rely on suppliers can be hard to model with the five forces method.

Since you can only make predictions based on available information, it’s not equally reliable across all industries.

In markets that evolve rapidly, sometimes changing overnight with new technologies, like SaaS, it can quickly become a snapshot of past expectations rather than a realistic prediction of the future.

Porter’s Five Forces example — Apple’s Smartphone Business

To showcase how you can put the model to work, let’s go through an up-to-date Porter’s Five Forces analysis for the Apple iPhone.

Competitive rivalry = high

When Apple released the iPhone, it was the first phone of its kind, and so they owned the entire marketplace. Since then, a steady stream of new competitors has transformed it into a diverse and competitive industry.

Apple only averages around 15% market share per quarter, and there’s fierce competition with companies constantly trying to one-up each other with smart new designs.

Threat of new entrants — moderate

Designing and manufacturing a smartphone isn’t easy, but the knowledge and infrastructure already exist — particularly in China.

Over the past few years, we’ve seen a number of new phone brands start to carve out a market for themselves — Oppo, realme, and more.

Many tech consumers show a surprising willingness to try completely new brands. And because you can easily hire talent or even entire factories that have produced competing products before, it’s not as prohibitive to new entrants as you might think.

Bargaining power of suppliers — moderate

Apple and other electronics makers rely heavily on scarce materials like rare-earth minerals to manufacture their products. The scarcity gives the supplier a lot of bargaining power, but the sheer volume and buying power of Apple means it still has leverage.

Bargaining power of buyers — moderate

With smartphones, telecommunications providers are major buyers that greatly impact phone sales. They’ll buy thousands of new phone models to package with data plans in special promotions.

But because of Apple’s own retail infrastructure (with Apple Stores worldwide) and strong brand, Apple doesn’t need these partnerships to sell its products.

Threat of substitution — moderate

While there are a lot of good smartphones out there, there are two factors that keep the iPhone’s substitution down — brand and user interface.

Having to relearn a new UI from scratch is the main switching cost of a smartphone. Since Apple uses its own OS and not Android, this means it has a lower threat of substitution than many other brands.

Apple’s strong brand reputation is the second factor at play. For many loyal Apple customers, switching to a new smartphone is simply unthinkable. Using Apple products has already become a part of their identity.

Conclusion

According to this analysis, things don’t look that great. Apple faces a moderate threat of substitution, fairly strong supplier and buyer bargaining power, and high levels of existing competition.

So does that mean Apple should just give up on smartphones? Not at all. Its brand power and premium prices give Apple the lion’s share of the profits in the market. In Q2 2021, Apple got 75% of the entire market profits, with only a 13% share of smartphone sales.

More than anything, this analysis showcases one of the weaknesses of Porter’s model: it doesn’t factor in the historical staying power of a brand.

So keep that in mind if your company has a product or service with similarly strong brand awareness.

How to create your own Porter’s Five Forces model and a long-term strategy for your business

If you want to do a reliable analysis, you should involve as many stakeholders as possible in a strategic planning meeting. It would be best to pull from a wide variety of expertise to get the evaluations right.

For example, someone on the e-commerce team could bring unique insight — like the threat of AmazonBasics — to your attention.

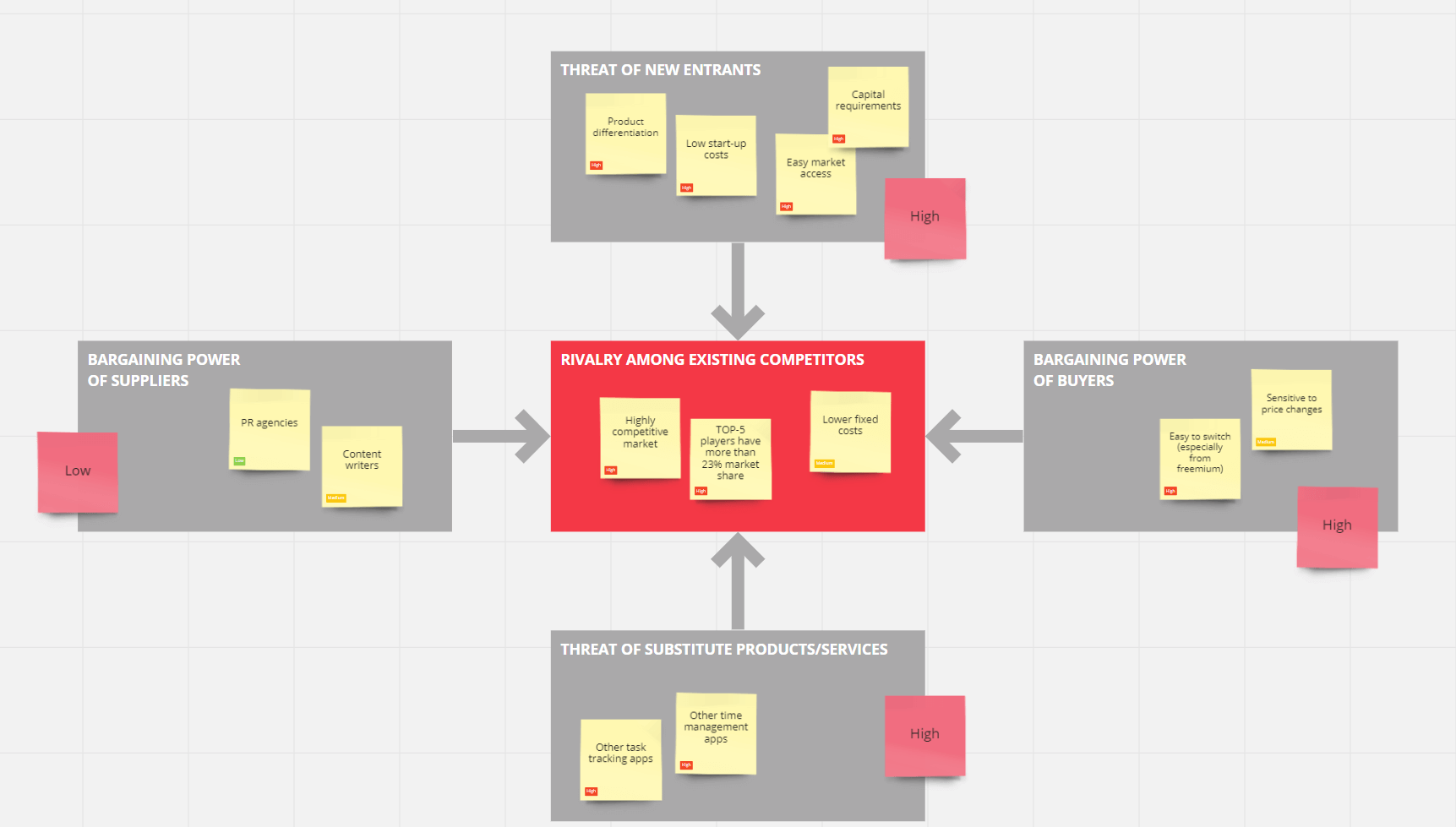

Start by dividing a whiteboard into five sections, one for each force. If your team is distributed or remote, you can use Miro’s virtual collaborative whiteboard with our Porter’s Five Forces template.

Once you’re ready, it’s time to get started.

Step 1. Evaluate your competitors

The first step is to evaluate the strength of your current competition. If you don’t have an active research team, you can invest in industry reports.

If you don’t have the budget, you can piece together data from quarterly reports yourself.

Focus on the following data points:

- The market share of your top competitors

- The total number of direct competitors

- Any competitive advantage you have (like proximity to suppliers or lower fixed costs)

Step 2. Calculate your suppliers’ bargaining power

Next up, you need to calculate the bargaining power of your suppliers. If you’re running an all-digital company, you may need to get creative.

Focus on the following aspects:

- The number of suppliers versus the number of manufacturers (high vs. low is best)

- If you buy significant volume from suppliers

- Any switching costs for you as a buyer (production delays, etc.)

Step 3. Evaluate your buyer’s bargaining power

After that, analyze your relationship with your customers. Do you sell directly to consumers? Are you reliant on high-volume purchases from retailers?

Focus on these factors:

- The switching costs of your customers

- Your volume of customers

- What percentage of your revenue comes from large-volume customers

Step 4. Identify the threat of potential new entrants to the market

This is where you take a hard look at your industry as a whole and evaluate barriers to entry. How much capital do you need to get started? Are there regulatory barriers making market access difficult?

Focus on these factors:

- Startup costs and overall capital requirements

- Regulations or other barriers to entry

- Research and development costs

Step 5. Evaluate the threat of substitution

Finally, it’s time to get real about the risk that a customer might change brands. Do you have direct competitors that offer a similar product at a similar price?

Focus on the following factors:

- Existing direct competitors

- Switching costs

- Adjacent competitors that may disrupt your business

- Meaningful product differentiation

Draw a conclusion and build on it to formulate your strategy

Discuss the different forces at play with your team and develop a cohesive conclusion.

Is your business model sustainable? Are you at risk of getting outcompeted on certain products?

To help you formulate a strategy going forward, consider the following questions:

- Which products should you invest in advertising to strengthen your brand?

- Should you divest from any product line or area of your business?

- Do you have any unique competitive advantages you can take advantage of?

Live collaboration is crucial if you want to get the most out of this process — so if you’ve got remote team members, don’t be afraid to give Miro a try. It’s free for unlimited team members!

When to avoid Porter’s Five Forces — and what to use instead

Porter’s Five Forces isn’t the end-all-be-all of competitive analysis. In some cases, there are better options for your company.

For example, if you’re in a fast-moving tech space, you may want to use other options.

Software and other digital industries

Does your company exclusively work within the digital economy? Then the focus on suppliers may not feel appropriate.

Even though you could technically consider cloud service providers like AWS suppliers, it’s not as relevant to the product’s final price.

It can also be hard to evaluate the real threat of substitution and the market state in fast-moving industries.

Since the priority should be on innovation and developing a unique competitive advantage, many tech companies prefer an Agile approach to product development.

A varied portfolio of products and services

Do you have a varied portfolio of products in different industries?

In that case, 5-Forces analysis can be very time-consuming. You need to analyze and understand every relevant industry or marketplace.

Instead, you can, for example, use the BCG Matrix for a high-level overview of your company’s entire portfolio and how you should prioritize between your products.

Use Porter’s Five Forces to Get an Overview of Your Competitive Landscape

Porter’s Five Forces model helps you get a clear view of your competitive landscape. That becomes the foundation for making strategic investment choices for future success.

By considering dynamics throughout the supply chain and research and development, you can find opportunities to carve out a unique competitive advantage in an industry.

With Miro, your whole team can collaborate over the internet in real time, making it perfect for remote or distributed teams.