The term “competitive market analysis” may sound like something reserved for the C-suite of Fortune 500 companies, but it can be incredibly valuable to any business.

Because no matter what industry you’re in, you’ll always deal with competition.

To stand out, you must identify what your competitors are doing and compare your current practices against theirs. This is exactly what a competitive market analysis is most often used for.

By performing a competitive market analysis, you can identify opportunity gaps, differentiators, and competitive advantages to grow your business.

Today, we’ll cover what a competitive analysis is and provide you with helpful tips and tricks so that you can use it in your organization.

Let’s start with the basics.

Try Miro’s Competitive Analysis Templates

What is a competitive analysis?

A competitive market analysis, also known as “competitor research,” is the process of comparing the different strategies of your competitors to find strengths, weaknesses, opportunities, and threats.

Competitive research also analyzes current and future trends, potential obstacles, how to overcome these potential obstacles, and any consumer pain points that may exist.

This type of analysis is useful to identify trends and pitfalls in your industry.

It’s not always easy to know if you’re on track compared to your competitors. Competitive analysis provides valuable insights into where you can focus your efforts.

Just keep in mind — doing an accurate competitive analysis takes time and expertise. You don’t want to cheap out or take shortcuts, as low-quality work could lead to poor decisions later down the line.

We’ll cover what goes into a competitive analysis a bit later, but first, let’s answer a crucial question:

What are the benefits of a competitive market analysis?

First, a competitive market analysis allows you to identify your strengths and weaknesses in comparison to your competition. This provides you with an in-depth understanding of your business’s position within its market.

Second, this type of research also helps you discover new opportunities that might not have been apparent without detailed analysis.

Some other benefits might include:

- Improve your products and services: Analyze what your competitors are doing right and wrong, and use that information to improve your own products and services.

- Identify competitive advantages: Understand what makes you different from your competitors and capitalize on it.

- Spot threats and opportunities: Identify potential threats to avoid and opportunities to tap into.

- Better understand your market: The more you know about what’s going on in your market, the better equipped you are to make decisions.

- Forecast the economic climate: Learn more about which companies are going to face more or less demand and how the market might evolve.

- Create an organized, more efficient marketing team: Having a good grasp of what’s going on in your market can make you better able to create a plan focused on your specific strengths.

Competitive market analysis best practices

Before we dive into the actual process of running a competitive analysis, let’s explore a few of the best practices to help you start off on the right foot.

Identify both direct and indirect competitors

A common mistake is to limit your analysis to direct, easily identifiable competitors. But this can lead to overlooking critical information.

For example, let’s say that you own a chewing gum brand in the U.S. and want to learn more about your competition.

In this case, the dental floss market could be an indirect competitor.

Chewing gum is often used as a substitute or alternative to flossing teeth, so brands of chewing gum could be considered indirect competitors of flossing businesses.

If you’re a competitive intelligence company, one of your indirect competitors could be any market research agency.

Both organizations help clients gain insight into their competitive environments.

Competitive intelligence helps clients understand how they stand in relation to current competitors, while market research helps them understand how their customers feel about them.

The point is that you should expand your analysis beyond direct competition and identify indirect competitors as well.

Well, how?

Here are a few ideas:

- Group similar businesses: Use business categorization tools to group similar business types together. For example, you could consider all online stores as a group of businesses that compete for buyers’ attention.

- Define the market: Consider which products and services you provide and what your customers’ needs are (i.e., the job they’re trying to get done). Then ask yourself, “What other products and services do customers use as an alternative?”

- Consider related product and service categories: Use the information you generated in step two to look at other businesses that offer similar products or services (e.g., chewing gum vs. dental floss).

Analyze industry trends

Take time to review how your industry has changed over time and evaluate any overarching changes. Also, look into new technologies that could potentially threaten or enhance your business model.

For example, if you’re a bar owner, you might want to look into the growth of microbreweries.

If you’re looking to boost sales of your line of salads, make sure you know which ingredients are trending. For example, imagine that black tilefish is predicted to surpass wild salmon as the most popular fish this year. By adding black tilefish to your dishes, you could make your menu more competitive.

This is a simple example, of course. The point is that you should identify what is changing in your competitive environment and adjust your strategy accordingly.

Here are some places you can look:

- Google Trends: Google Trends provides a snapshot of current industry trends. Use it to find out what people are searching for and identify which topics are trending up or down.

- Industry forums: Sign up for industry forums and mailing lists to stay on top of market changes over time. Other companies involved in your industry may be doing new things.

- Social media: Look for announcements on social media, press releases, and relevant websites, such as trade groups and government agencies.

Write a SWOT analysis

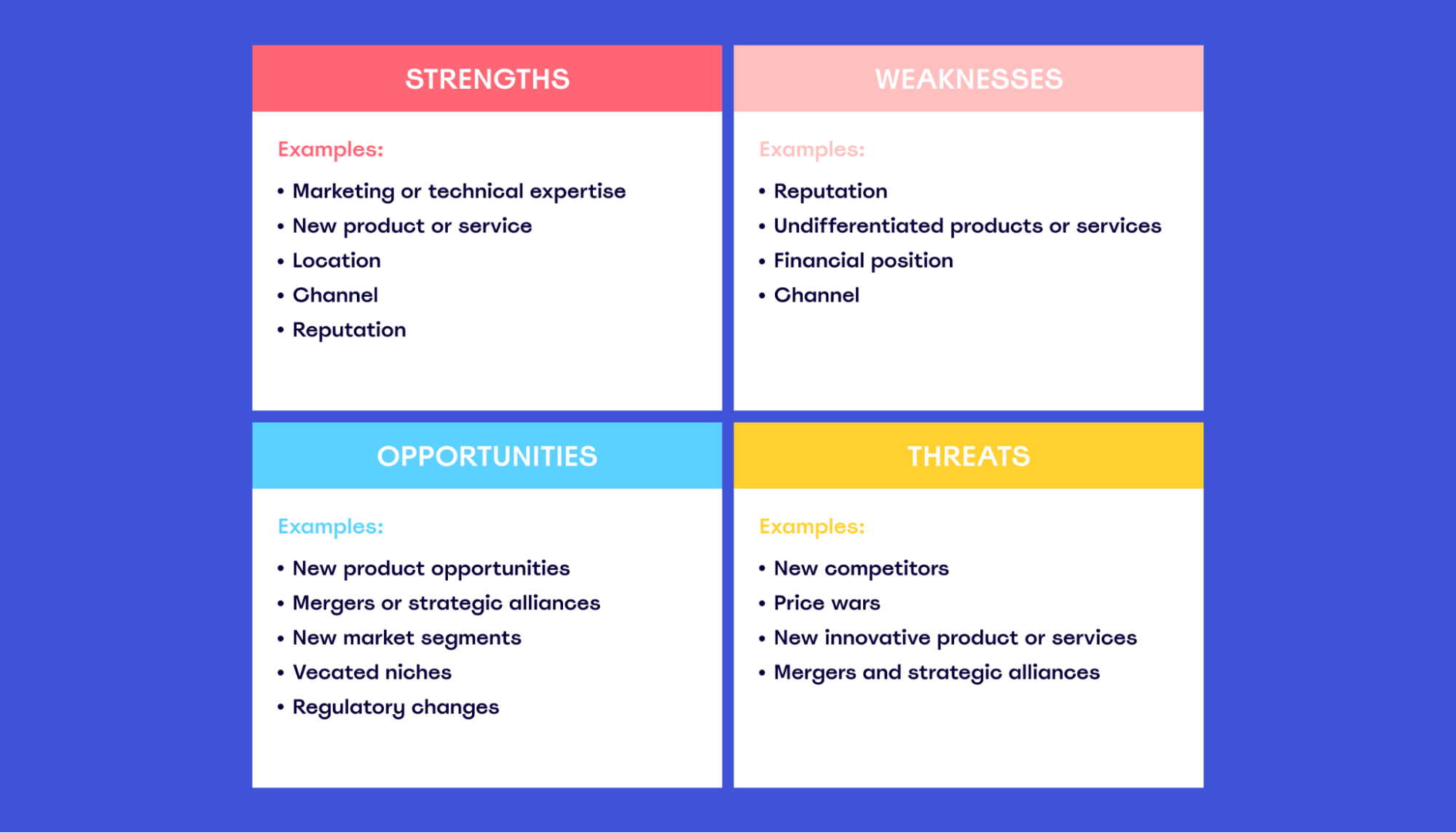

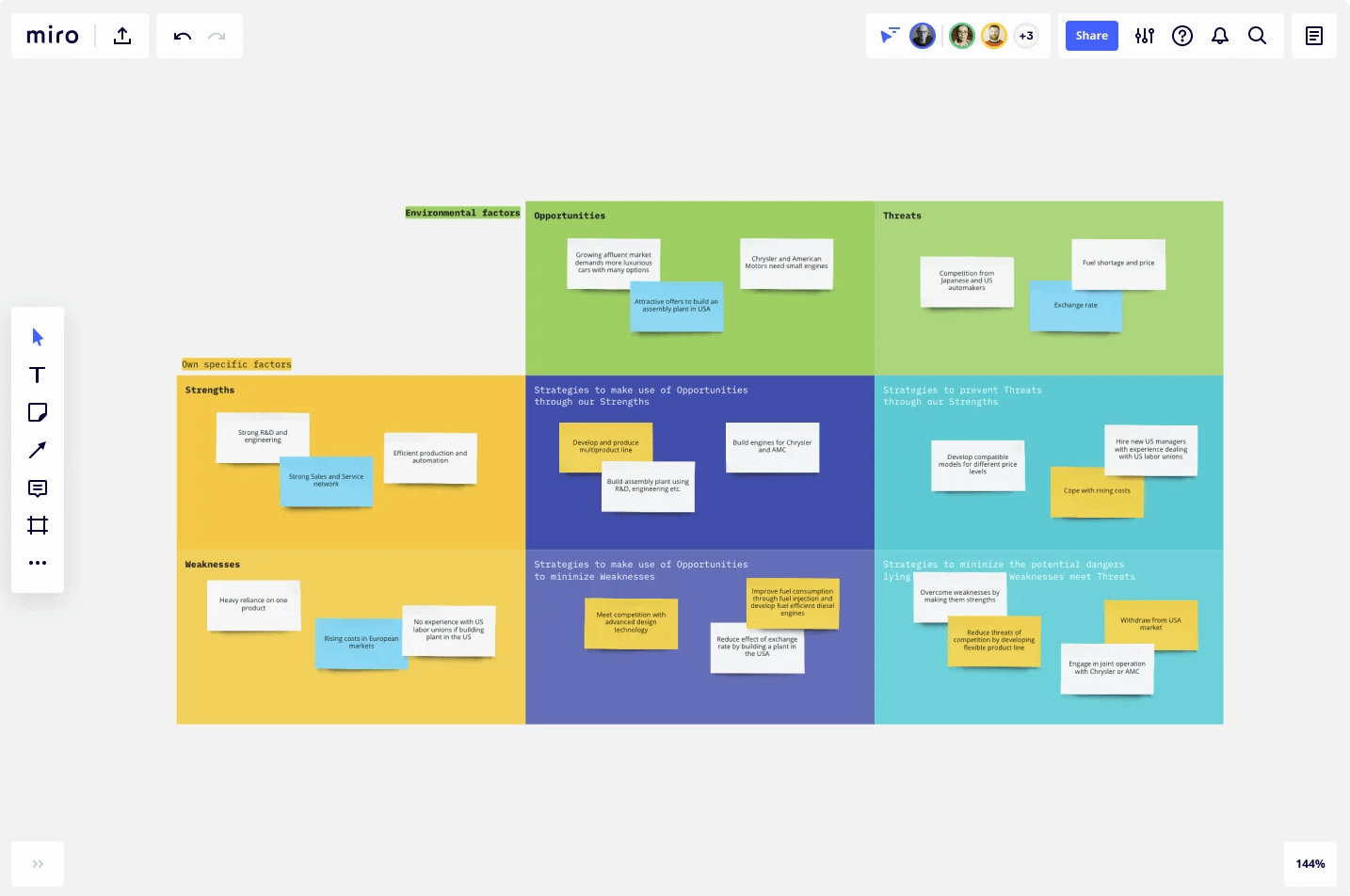

Writing a SWOT analysis is a must-have when performing competitive research. SWOT is a competitive analysis matrix that helps you understand your strengths, weaknesses, opportunities, and threats.

With our SWOT analysis template, you can get started in minutes.

You can edit this template to collaborate with your team and use your findings to pinpoint areas for improvement within your organization. You can also use sticky notes to visualize ideas and track them over time without limiting yourself to lines.

Additionally, you can attach files and share them with any relevant team member, which allows your entire team to have access to the key competitive analysis results. Feel free to expand concepts with mind maps or other frameworks.

You can also develop strategies based on changes outside of your control and highlight risks posed by unfavorable factors.

Within each SWOT category, rank each element using both objective data points, as well as estimates and opinions. This will allow you to weigh each threat or opportunity accordingly instead of taking everything at face value.

Remember that competitive research isn’t a one-off exercise

Your goal isn’t to deliver an amazing report that gets put on a shelf. It’s critical that you keep up with your competitors and be aware of any changes in their business strategy.

That way, you can adjust your own business strategy accordingly, giving yourself an edge over all your other competitors.

Some ideas to stay on top of competitors include:

- Google News: Set up alerts on Google News to stay updated on your competitive market analysis.

- LinkedIn: Use LinkedIn search to find out who works at your competitors and follow their activities.

- Blogs and publications: Read industry-relevant publications to learn about new acquisitions, ventures, or product developments that could change the competitive landscape.

Doing this will help you anticipate trends in your industry, uncover insights on what competitors are doing right or wrong, and make more effective business decisions.

How to write a competitive market analysis

Now that you understand the best practices for conducting a competitive analysis, the question becomes, how can you actually implement one in your organization?

Here’s how to do a competitive analysis in seven easy steps:

1. Use the right template

The right template can help you standardize your analysis and collaborate with your team more effectively. By creating an SOP (Standard Operating Procedure) for your analysis, you’re able to save time and ensure that the company is taking a systemic view of what’s going on in the market.

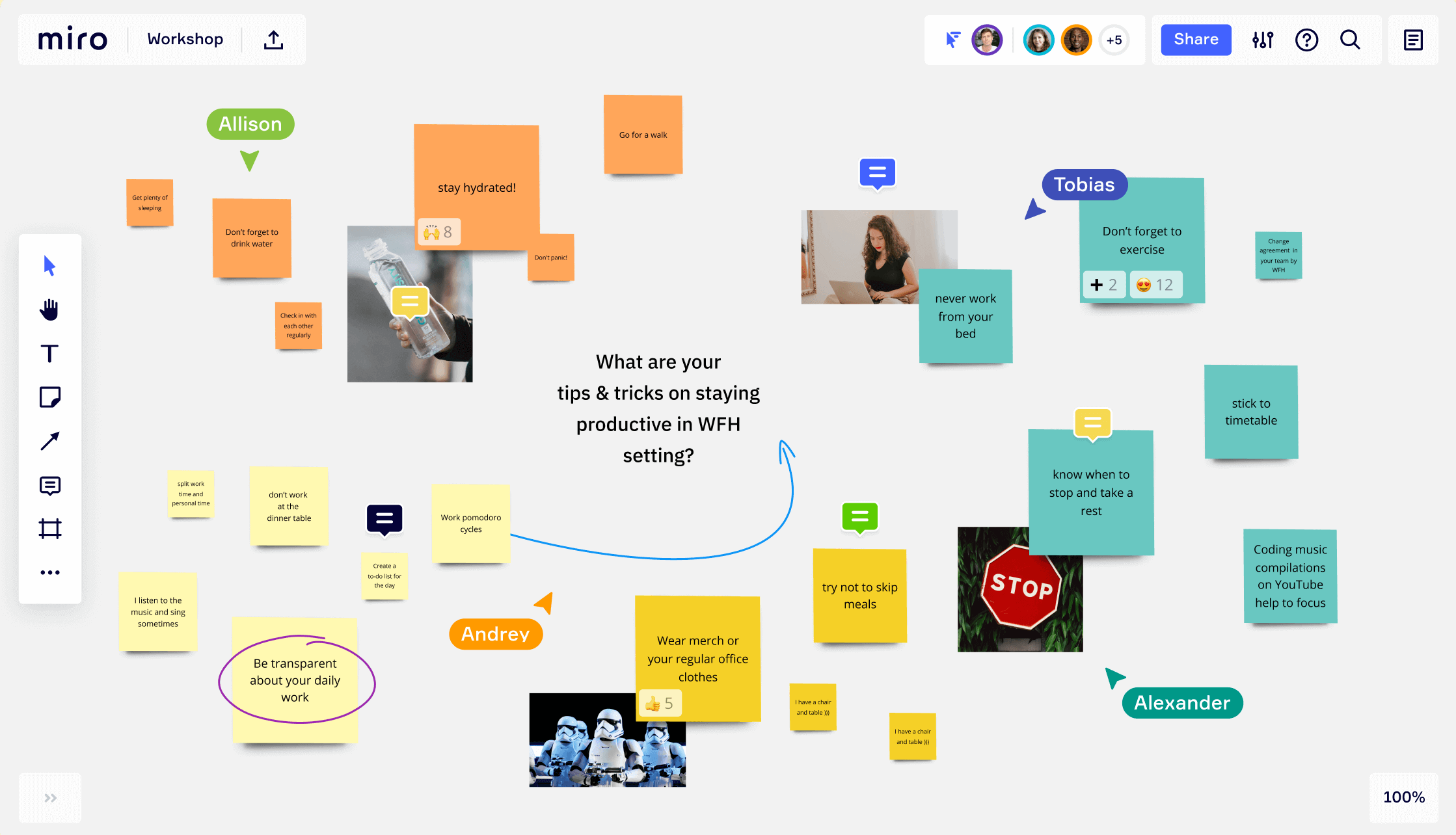

With our competitive analysis template, you can jumpstart your market intelligence and brainstorm with your team in real-time.

This template is fully customizable and you can adapt it to your exact needs in minutes. For example, you can edit fields by double-clicking on them, add sticky notes to highlight important areas, and remove fields that you don’t need.

You can also import relevant files and make them available to team members.

Additionally, you can share this template with any relevant people in your organization, including peers, clients, and stakeholders. This way, you can collaborate and get your analysis done faster and more effectively.

In essence, you can use this template to hold collaborative sessions where everyone adds their ideas and insights at once, using a single, unified dashboard.

Try Miro’s market analysis templates.

2. Make a list of the competitors you want to analyze

Once you’ve established a standard operating procedure for your research, it’s time to create a list of the competitors you want to analyze.

You don’t have to include every competitor in the market, though. Just choose those competitors that seem most relevant to your business.

How can you find competitors?

Here’s a simple method:

Head over to Google and type in the product or service you’re offering. Look at the results that pop up and see if any companies that provide a similar service. If they do, add them to your list and keep going through this process until you think you’ve found them all.

If you’re having trouble finding direct competitors, look for companies that offer complementary solutions. If you’re an email marketing company, look for businesses that provide, say, web design. And in turn, if you’re a web design company, look for companies that offer marketing services. This will help you to get a full view of the competitive landscape.

3. Analyze your competitors’ strategy

Now that you have identified your competitors, it’s time to dissect their strategies. This includes everything from their pricing to where they are getting their leads and even their sales process.

The more details you can learn about each of your competitors, the better off you’ll be at formulating your own marketing strategy.

Read any whitepapers, blog posts, and case studies produced by your competition, and try to identify patterns that you could use to your advantage. While we don’t recommend stealing tactics, there’s no harm in taking inspiration and incorporating what works into your own plan.

Use tools like Google Alerts or Mention to monitor your competitors and track their marketing activities. You can also use social media platforms, like Twitter and LinkedIn, to find out when your competitors are running promotions, attending industry events, and hiring new employees.

And don’t forget to look for other sources of valuable intel, including:

- Career pages: Keep an eye out for job postings, which could indicate that they are hiring new staff to support their growth.

- Public media: Look at the publicly available information, such as press releases and SEC filings.

- Product pages: This is where you can find out more about the types of services they offer and who their target market is. You can also get an idea of what kind of language they use, which you can emulate in your own copy.

- Social media comments: Read the comments they get on social media to understand what people are saying about their products.

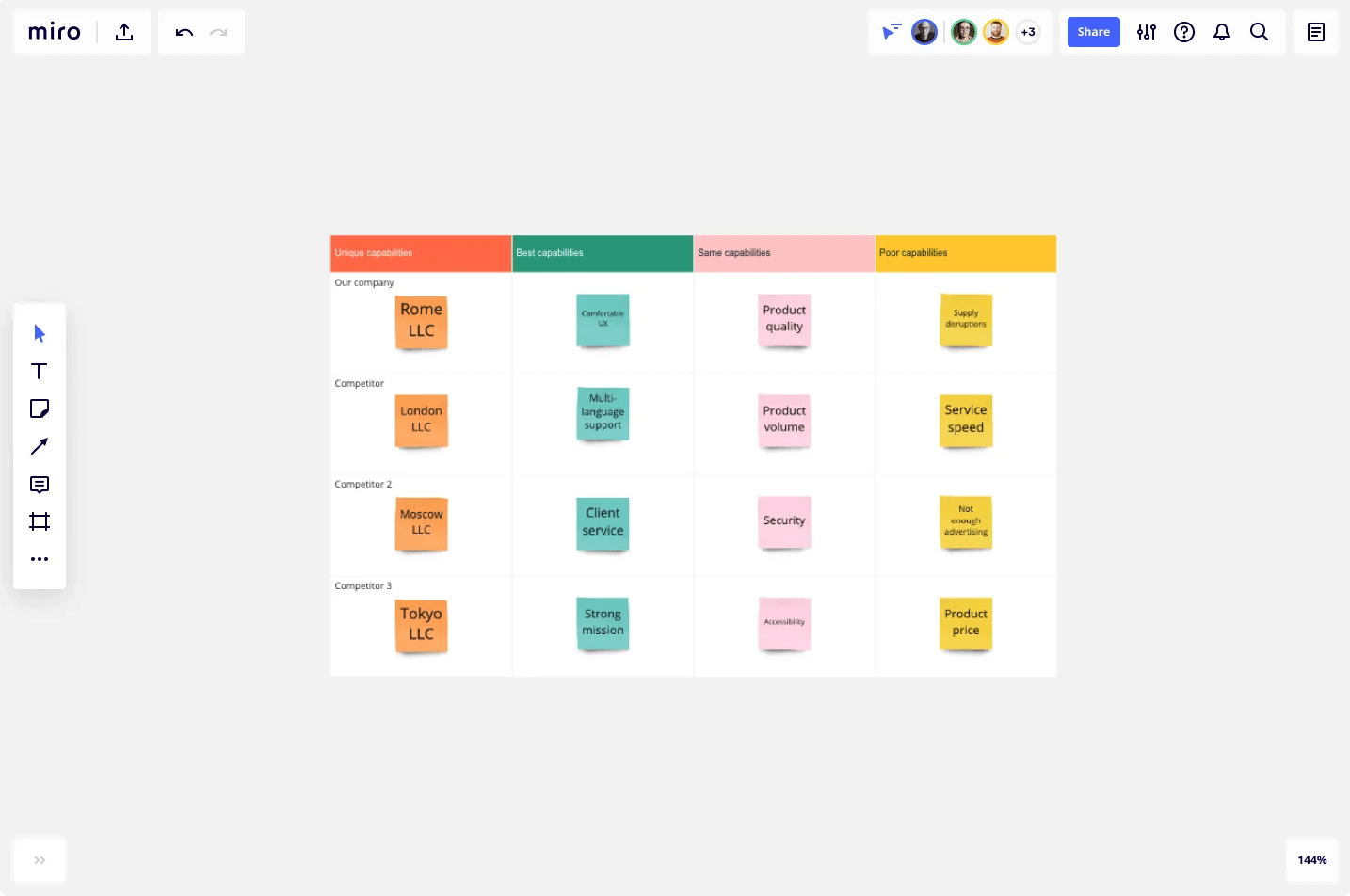

4. Analyze your competitors’ products and services

Your competitive analysis should not only reveal where your competitors are strong but also where they are weak.

Look at your competitors’ prices, product features, and specialties. Then, you can figure out how you can be unique in comparison.

At this stage, try to answer these questions:

- What products and services do they offer?

- What is their pricing?

- What features do they offer?

- Are there any features they provide for free?

- What problems do they solve?

- What does their buyer persona look like?

- Which products are more popular or have a higher price point?

- Do they have any weaknesses that you can take advantage of?

- What channels do they use to reach their target market?

A thorough evaluation of your competitors will give you an idea of how much room there is for improvement and help you create more compelling messaging.

5. Take note of your competitor’s positioning

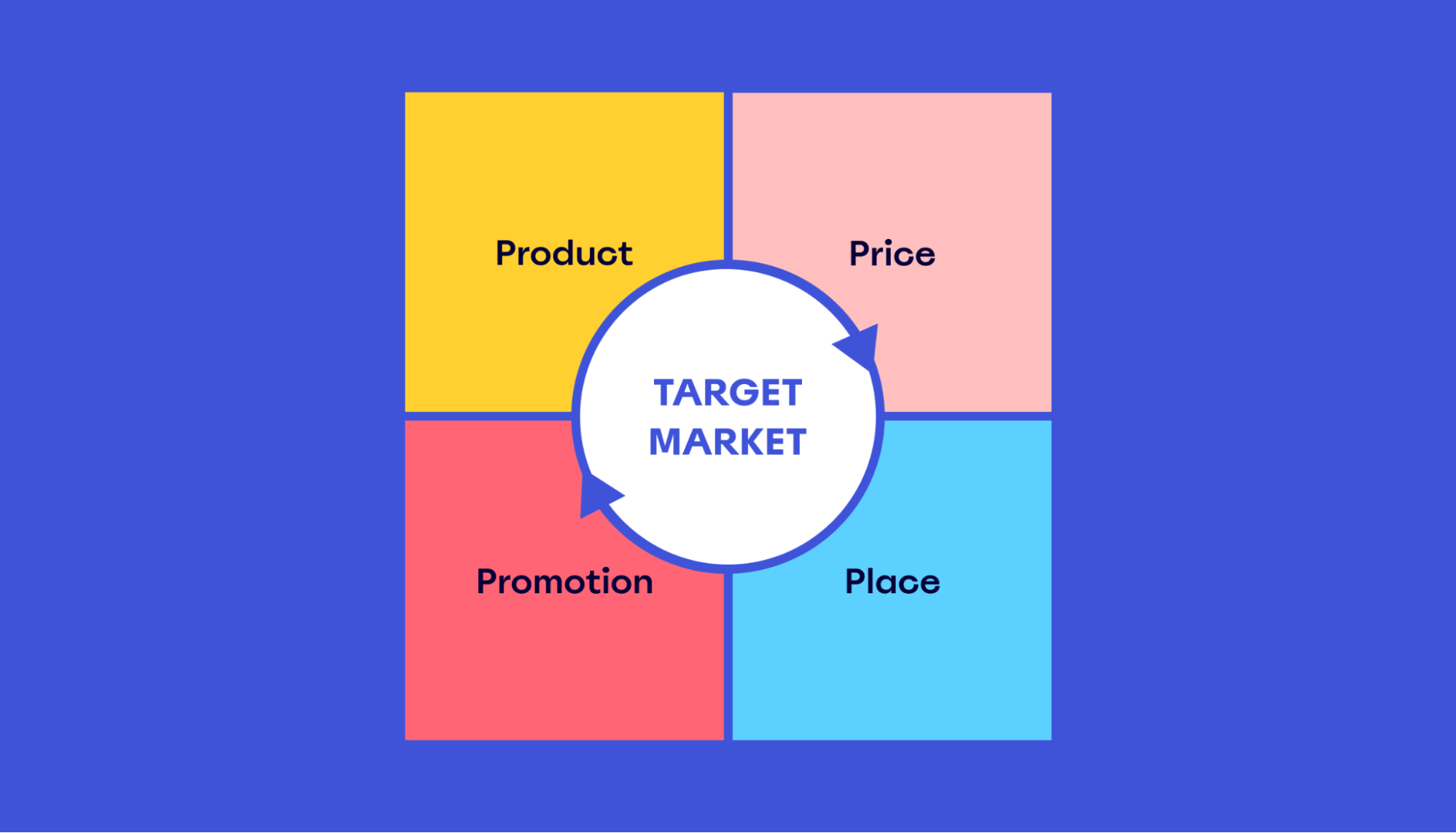

Analyzing your competitors’ product, pricing strategy, and which channels they use to reach customers will start to reveal your competitors’ positioning in the market.

You’ll also want to consider how they promote themselves. That is, the message they’re “writing” in the minds of the target audience.

What kind of materials are they using? Landing pages? Press releases? Social media marketing campaigns? Analyze those pieces and determine how they’re positioned toward a certain audience.

During your analysis, ask yourself:

- What kind of language do they use to describe themselves?

- Where do they position themselves in relation to other companies?

- Are they the best? Are they the cheapest?

- How do their messages compare to yours?

- What can you learn from them about your own messaging and marketing strategies?

- Who are they targeting, and how does their messaging and imagery appeal to their audience?

- What kind of language is used in their product descriptions?

- How can you adapt your own messaging to appeal to the same kind of people?

Understanding where your competitor is aiming their message can help you better define who your target market should be. This information can also support any rebranding efforts.

6. Learn what technology your competitors are using

Do your competitors use any special technology to achieve their goals? For example, are they using industry-specific software or hardware?

Look at what software and hardware your competitors use and create a list.

- Are they using any open-source tools? If so, could you build off their work and use the same tools to save time and money?

- If they use certain software that you can’t afford, can you find alternative solutions that might be cheaper?

- What about off-the-shelf software packages? Are there any that you can use to outsource certain tasks and save money?

Create a purchase list of the technology your competitors use, and add any tools you would like to buy later on. Even if you don’t end up buying everything immediately, it can be useful to keep a list for future reference.

7. Monitor the competition

It’s important to monitor how your competitors are doing business over time and cross-reference your findings. This will help give you a better continuous picture of your competitive market.

Here are the main areas that you should constantly be monitoring:

- Business growth: How many new locations has your competitor opened? What deals and collaborations has the company announced recently?

- Mergers and acquisitions: Has your competitor been bought, sold, or partnered with another business? How will this change the company’s position in the market?

- Financial health: Is your competitor expanding or cutting back? Are they profitable or in debt?

- Investments: Keep an eye out for new investments like this that competitors are making. They may indicate a big shift in strategy.

- Funding: Has your competitor raised money recently? How much did they raise, and from whom?

- Products and services: Are your competitors coming out with new products or services?

- Business strategies: Is your competitor changing their pricing model, promotional strategy, or branding?

Answering these questions will help you create a thorough competitive market analysis and guide your business decisions.

It will also help you determine if it’s time to hire new talent, expand into a new market, or launch a new product.

The bottom line?

With the increasing level of competition modern organizations deal with, performing a competitive analysis is no longer just an option — it’s a must.

A competitive analysis can help organizations stay ahead of the curve by providing insights into their competitor’s strengths, weaknesses, opportunities, and threats.

You can increase your chances of success by using the right tools, asking the right questions, and organizing your data in a way that makes sense.

Hopefully, now you have enough information to implement a competitive analysis and get valuable insights to improve your brand.

Stay ahead of the curve. Try our Competitive Analysis Template.